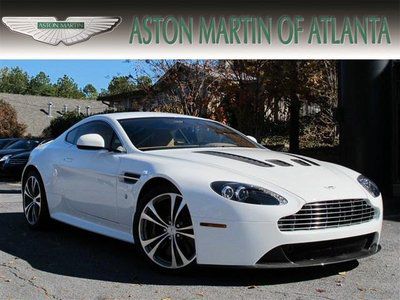

2012 Aston Martin V12 Vantage! Low Miles One Owner Premium Audio Clear Bra! on 2040-cars

Atlanta, Georgia, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Aston Martin

Model: Vantage

Warranty: Vehicle has an existing warranty

Mileage: 1,550

Sub Model: V12 VANTAGE

Options: Leather Seats

Exterior Color: White

Power Options: Power Windows

Interior Color: Tan

Number of Cylinders: 12

Aston Martin Vantage for Sale

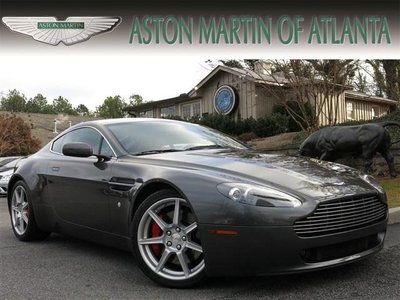

2008 aston martin vantage 10,523 miles 380hp 6-speed leather call shaun

2008 aston martin vantage 10,523 miles 380hp 6-speed leather call shaun Meteorite silver power package sport exhaust great options!(US $63,500.00)

Meteorite silver power package sport exhaust great options!(US $63,500.00) Amazing carbon fiber amv8 vantage coupe - track or show(US $124,900.00)

Amazing carbon fiber amv8 vantage coupe - track or show(US $124,900.00) Sportshift+parking sensors+navigation+loaded!(US $76,999.00)

Sportshift+parking sensors+navigation+loaded!(US $76,999.00) 2012 aston martin vantage roadster,wht/tan,msrp$162,740(US $139,999.00)

2012 aston martin vantage roadster,wht/tan,msrp$162,740(US $139,999.00) 2009 aston martin vantage $0 down/$1000 a month@84 months coupe leather loaded(US $75,991.00)

2009 aston martin vantage $0 down/$1000 a month@84 months coupe leather loaded(US $75,991.00)

Auto Services in Georgia

Youmans Chevrolet Co ★★★★★

Xtreme Window Tinting ★★★★★

Valvoline Instant Oil Change ★★★★★

Tribble`s Automotive Inc ★★★★★

Top Dollar for Junk Cars ★★★★★

Sun Shield Window Tinting ★★★★★

Auto blog

Check out King Charles III's $17.6 million car collection

Fri, May 5 2023King Charles III's coronation will take place in England on May 6, and being crowned a monarch comes with a long list of perks with four wheels. He will gain full access to the Royal Family's fleet of cars, which is valued at about GBP14 million (approximately $17.6 million). The two most expensive cars in the collection are nearly identical: they're a pair of Bentley State Limousine models (pictured) built for Queen Elizabeth II, King Charles III's mother, in 2002. Only two units were made, and they're both part of the Royal Family's fleet, so they're difficult to put a value on; it's not like one is going to end up listed on your favorite auction site anytime soon. British company Nationwide Vehicle Contracts, which compiled the list, estimates that each armored, 245-inch long sedan is worth at least GBP10,000,000 (roughly $12.6 million). Dropping below the eight-digit threshold, the second-most-valuable car in the Royal Family's fleet isn't really a car. It's the Gold State Coach, which Matchbox recently released a 1/64-scale replica of, and its value is estimated at GBP1.6 million (about $2 million). At 275 inches long it's even bigger than the Bentley limousine and it weighs about 9,000 pounds. It's 261 years old and designed to be pulled by eight horses, and has been part of every coronation since 1831. The rest of the Royal Family's vehicles are relatively mundane. There's a 1965 Aston Martin DB6 Volante that Queen Elizabeth II and her husband, Prince Phillip, bought for King Charles III on his 21st birthday. It's worth GBP1 million (about $1.2 million). The collection also includes a Rolls-Royce Phantom VI (about $627,000), a Bentley Bentayga (about $201,000), a Land Rover Range Rover long-wheelbase Landaulet ($133,000), a Jaguar XE (about $41,000), and a Land Rover Defender ($38,000). "Luxury cars have long been associated with the monarch and King Charles III, in particular, is known for his fondness of motor vehicles. His impressive collection features sentimental value with motors passed down from his late mother, Queen Elizabeth II, to cars bought for him by his parents," explained Keith Hawes, the director of Nationwide Vehicle Contracts, in an interview with CBS News. Being at the head of a car-making nation's royal family also comes with drawbacks: Every vehicle in King Charles III's fleet is British.

Aston Martin Valhalla project rebooted with Mercedes-Benz technology

Thu, Feb 25 2021Aston Martin will leverage its access to the Mercedes-Benz parts shelf to revise the Valhalla it plans to release in the coming years. Specifications haven't been finalized yet, but the supercar will most likely arrive with a German heart. Announced in early 2019 as the Project 003, and named Valhalla later that year, the Ferrari-punching model was on track to make its debut with a 3.0-liter turbocharged V6 mounted behind its passenger compartment. Aston Martin proudly pointed out that the six was the first engine it developed in-house since the Tadek Marek-designed 5.3-liter V8 entered production in 1969. These plans changed after Daimler purchased a 20% stake in the firm, however. Aston Martin boss Tobias Moers (whose last position was at the head of Mercedes-AMG) told investors that his team is "re-assessing" the Valhalla, and that it will "probably have a different drivetrain" than the concept. He didn't reveal what the model will be powered by, and he stressed that nothing is off the table. Mercedes-Benz has a wide range of four-, six-, eight-, and 12-cylinder engines in its parts bin, plus hybrid technology and electric motors. Electrification remains in the pipeline regardless of the path the company chooses to take. "With the transformational technology agreement with Mercedes-Benz, there are other chances for us regarding combustion engines, but we still have an electrified drivetrain," he said without providing more specific details. It sounds like Aston will make visual tweaks to the Valhalla, too, because Moers revealed that buyers will be shown an updated version of the car in the next four months. It's unclear whether it will be presented to the public, too. Regardless, the car's introduction is tentatively scheduled for late 2023, so it will likely arrive here as a 2024 model. Moers confirmed that a plug-in hybrid model with what he described as "a reasonable electric range" will join the Aston Martin range in the coming years, too. He added that three new variants of the DBX, the firm's first SUV, are on their way as well. One is a plug-in hybrid. Details about the others aren't known, but another could be a sportier version positioned at the top of the range. Finally, the first electric Aston Martin will arrive in about 2025.

Aston Martin DB11: Everything we know right now

Mon, Jan 18 2016With six and a half decades of heritage, the Aston Martin DB is one of the most storied nameplates in the savory sports car stratosphere. And we're (probably) just weeks away from seeing the next major chapter: the DB11. A few exclusive spy shots reveal new details, and we've gathered some crucial intelligence to help us get a better idea of what we can expect from the new DB11 when it launches later this year. Much like how the previous DB9 ushered in a new generation of cars from Aston's Gaydon, UK, headquarters, the British carmaker says the DB11 will kick off its "Second Century Plan." An insider told us that Aston is in the final tuning stages, and as such, the engineering prototype pictured here is likely the closest thing we've seen to a final production-spec car. While early mules had moldings and panels, we now have a good sense of the DB11's proportions, and can clearly see the rear-wheel-drive coupe's character lines. We can also see an aero-lip intake under the grille that appears to be significantly wider than on the DB9. Beyond being aesthetically pleasing, this is a necessary addition for better cooling. Our sources tell us power is expected to be above that of the naturally aspirated V12 Vantage's 565 hp and 458 lb-ft of torque. Gaydon's partnership with Daimler will soon yield the new Mercedes-AMG 4.0-liter twin-turbo V8 engine for use in Aston Martin cars, but the Brits surprised us recently by showing a teaser of a 5.2-liter twin-turbo V12. The timing is curious, and makes us suspect that the DB11 will continue the 12-cylinder tradition, despite the pressure to be increasingly fuel efficient. Our sources tell us power is expected to be above that of the naturally aspirated V12 Vantage's 565 horsepower and 458 pound-feet of torque. While the current DB9 boasts a six-speed automatic gearbox, we understand the V12 will be mated to a new transmission with more speeds. It's possible the DB11 could get the ZF-sourced eight-speed automatic that Aston recently added to the Vantage and Rapide range. The DB11 will ride on an all-new chassis, and in continuing the industry trend, the new car should be lighter, tipping the scales below the current DB9's 4,000-pound mark, despite some new equipment. The Daimler partnership should improve a major area where Aston has historically lacked: in-car technology and infotainment.