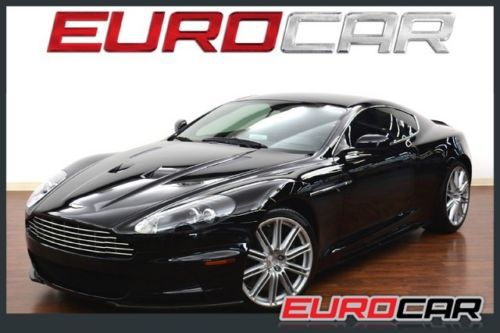

2011 Aston Martin Dbs 2dr Cpe on 2040-cars

Woodland Hills, California, United States

Aston Martin DBS for Sale

2009 aston martin dbs/ just serviced/ new tires/ crystal key

2009 aston martin dbs/ just serviced/ new tires/ crystal key 2009 used 6l v12 48v manual coupe premium(US $129,900.00)

2009 used 6l v12 48v manual coupe premium(US $129,900.00) Rare carbon edition dbs quicksilver exhaust factory warranty(US $197,999.00)

Rare carbon edition dbs quicksilver exhaust factory warranty(US $197,999.00) 2010 dbs coupe,6 speed trans,nav,htd lth,b&o sys,park sensors,20's,7k,we finance(US $149,900.00)

2010 dbs coupe,6 speed trans,nav,htd lth,b&o sys,park sensors,20's,7k,we finance(US $149,900.00) 2011 aston martin dbs volante carbon black limited edition(US $185,000.00)

2011 aston martin dbs volante carbon black limited edition(US $185,000.00) Aston martin dbs, highly optioned, immaculate condition, california car(US $134,777.00)

Aston martin dbs, highly optioned, immaculate condition, california car(US $134,777.00)

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

2022 Aston Martin DBX Review | 2 exceptional cars for the price of 2

Tue, Feb 22 2022PORTLAND, ORE. – It is so easy to greet the Aston Martin DBX with a great big eye roll. Here we go again, yet another purveyor of beautiful sporting machines selling out to produce a bloated SUV that's utterly anathema to all the cars that came before. Yet another cynical brand exercise where some classic styling cues and a desirable badge are applied to someone else's SUV platform. And yet another SUV that's hopelessly compromised by those same brand affectations. Worse, this is Aston Martin. If you take away the DB5-derived body style and GT driving experience, what exactly are you left with? Aren't those the best reasons to buy one instead of a Porsche? In other words, the arrival of a $222,000 Aston Martin wasn't necessarily greeted by giddy clapping and the score of "Goldfinger" turned up to 11. Skepticism would be the word. Yet, immediately, it started to erode. It may be an SUV and certainly bloated compared to a Vantage, but it sure is pretty. And not just because of that trademark grille and Vantage-like ducktail. It's all about the proportions. The pronounced body-length shoulder line and inboard fastback greenhouse may evoke Aston's cars, but it also avoids the tall, slab-like profile of a Porsche Cayenne and most other SUVs. The wheels are pushed to the corners, elongating the body and creating the sort of long hood, short deck proportions one expects from a two-door GT and definitely not an SUV. Even without the styling cues, the thing looks like an Aston Martin. The DBX is also not on "someone else's SUV platform," it was created by Aston Martin for Aston Martin. So unlike the Bentley Bentayga, Lamborghini Urus and earlier Cayennes, Aston Martin didn't need to contend with the sort of existing, unchangeable hard points that lead to awkward proportions. This can also have practical benefits. Take that elongated wheelbase, for example, which is 2.6 inches longer than the Bentayga's despite the entire DBX being 3.4 inches shorter. Much like the similarly from-scratch Jaguar F-Pace, I suspect Aston Martin made the DBX wheelbase so long for the aforementioned aesthetic reasons and because, unshackled by an existing platform, it could. Yet, like the F-Pace, the happy side effect to a long wheelbase is extra interior space. In the DBX, the amount of extra space is genuinely surprising. We fit an enormous Britax rear-facing child seat in the rear and had the front passenger seat pushed far enough back for someone 6-foot-3 to comfortably sprawl out.

2015 Aston Martin Vanquish [UPDATE]

Wed, Dec 24 2014There's something really special about an Aston Martin Vanquish. It's not my favorite model in the British automaker's range – I'm more of a Vantage guy, if I'm being choosy. But every time I drive one, I feel like I'm piloting something fit for royalty, $300,000 price tag and all. It's stunning to look at, even in the rather drab shade of gray pictured here. It makes an absolutely killer noise, the free-breathing V12 firing from beneath the hood and out the back with a truly intoxicating sound. And from behind the wheel, it feels like a truly proper grand tourer. Well, almost. The one major hiccup with the Vanquish I drove last year was its six-speed automatic transmission. In a word, it was awful. Really jarring shifts, delayed manual control through the paddles, and really, just a hugely misaligned piece of an otherwise excellent puzzle. So I was happy to hear that for 2015, Aston Martin had fitted a new, ZF-sourced, eight-speed unit – you know, the transmission being used by automakers like BMW, Jaguar, Audi, and many more. I normally have zero issues with this silky gearbox. But in the Vanquish, it wasn't smooth sailing like I expected – it feels like it still needs some final calibrations. But that doesn't make this car any less special. Drive Notes I love this engine. The 5.9-liter, naturally aspirated V12 makes 569 horsepower and 465 pound-feet of torque, and it absolutely loves to rev. That's a good thing, since the siren song of the Vanquish's V12 is most pronounced at higher engine speeds. In fact, it's not really all that audible right from the get-go. You have to work it up past 2,500-3,000 rpm before this thing really starts to sing. But when it's turned up to 11, it's one of the best-sounding engines I've ever heard. That said, getting the Vanquish going is kind of an awkward process. There's a surprising momentary lack of power delivery right at throttle tip-in, and then the Vanquish suddenly jolts forward. It's alarming – I found myself raising an eyebrow and yelling "GO!," especially when trying to quickly merge into the traffic flow. But it'll go, when it's ready, and hitting 60 miles per hour takes just 3.6 seconds. The transmission is still an issue here. When left to its own devices, it doesn't have a problem finding the right gear for the occasion, but the actual shifts don't fire off with the smoothness and quickness that I've come to expect from this tranny in other models.

Kahn Design to reveal Aston Martin Vengeance in Geneva

Mon, Feb 15 2016The major automakers won't be the only ones with new metal to showcase in Geneva next month, so will aftermarket tuners and coachbuilders like Kahn Design. The British outfit is rolling into the Swiss expo this year with the long-awaited Vengeance, its own take on the Aston Martin DB9. We first caught wind of the Vengeance project in May – just after a similar project by Henrik Fisker was quashed. But unlike the proposed Fisker Thunderbolt, Kahn secured Gaydon's blessing in developing the Vengeance: "Aston Martin has entered into a supply agreement with Kahn Design," AML spokesman Kevin Watters confirmed to Autoblog at the time, "and will supply a very limited number of DB9s for an extensive coachbuild conversion." The design, as you can see, bears the familiar hallmarks of a contemporary Aston, but rendered more aggressive in a style that looks similar to the manufacturer's own One-77. It won't be the first such coach-built Aston Martin we've seen, but most of the others to date have resulted from a longstanding collaborative effort between the British automaker and famed Italian carrozzeria Zagato. Another recent project saw Bertone convert a Rapide into the Jet 2+2 shooting brake in a revival of the Vanquish-based Jet 2 from 2004. In a bit of a role reversal, Aston served as something of a coachbuilder itself in rebodying the Toyota/Scion iQ as its own Cygnet, having previously outsourced production of the Rapide to contract manufacturer Magna Steyr. Alongside the Vengeance, Kahn plans to display the Flying Huntsman 6x6 pickup based on the Land Rover Defender at the Geneva Motor Show. It will be joined by a customized red Range Rover and blue Range Rover Sport done up as pace cars, and a widebody Jeep Wrangler from its Chelsea Truck Company division. Related Video: