1972 Aston Martin V8 Dbs Series Ii In Highly Restored Condition. on 2040-cars

Southampton, New York, United States

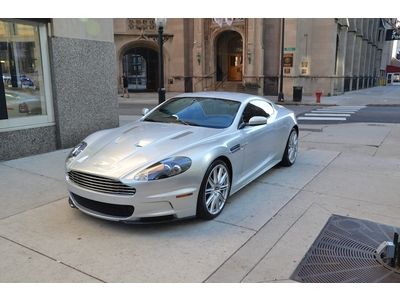

Body Type:Coupe

Engine:8 Cylinder

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Interior Color: Blue

Make: Aston Martin

Number of Cylinders: 8

Model: DBS

Trim: Leather

Drive Type: 2 wheel

Mileage: 32,439

Sub Model: Series II

Disability Equipped: No

Exterior Color: Silver

Aston Martin DBS for Sale

Dbs volante - blacked out beauty - low miles - alcantara - black wheels(US $193,900.00)

Dbs volante - blacked out beauty - low miles - alcantara - black wheels(US $193,900.00) 2009 aston martin dbs coupe(US $155,000.00)

2009 aston martin dbs coupe(US $155,000.00) 09' dbs coupe, visit us on the web @ www.astonmartindallas.com(US $155,967.00)

09' dbs coupe, visit us on the web @ www.astonmartindallas.com(US $155,967.00) 2010 aston martin dbs automatic $ 286,000 msrp call roland kantor 847-343-2721(US $187,900.00)

2010 aston martin dbs automatic $ 286,000 msrp call roland kantor 847-343-2721(US $187,900.00) 2009 aston martin dbs coupe lightning silver 6 speed manual(US $159,800.00)

2009 aston martin dbs coupe lightning silver 6 speed manual(US $159,800.00) 2009 aston martin dbs 6 speed black 2 tone red black interior(US $168,800.00)

2009 aston martin dbs 6 speed black 2 tone red black interior(US $168,800.00)

Auto Services in New York

Zuniga Upholstery ★★★★★

Westbury Nissan ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Value Auto Sales Inc ★★★★★

TM & T Tire ★★★★★

Auto blog

Aston Martin stock price shaken and stirred by latest weak outlook

Tue, Jan 7 2020Aston Martin warned its 2019 profits would almost be cut in half due to weak European markets, sending its shares sharply lower as rivals Bentley and Rolls-Royce powered ahead. Tuesday's downgrade is the latest from the British luxury carmaker, whose shares have now plunged about three quarters in value since their 2018 listing. The 107-year-old firm, famed for being fictional agent James Bond's brand of choice, cut its forecast for wholesale volumes and profit margins in July, and reduced its volume forecast again in November. It has blamed weak UK and European markets and subdued demand for its Vantage model and said on Tuesday those conditions continued through December, leading to a 7% drop in wholesale volumes for 2019. "From a trading perspective, 2019 has been a very disappointing year," Chief Executive Officer Andy Palmer said, as the company's shares plunged as much as 16%. While Aston spent 2019 ploughing money into a new factory to build its first SUV, the highly lucrative market a number of carmakers have entered, rivals such as BMW-owned Rolls-Royce and Volkswagen-owned Bentley appear one step ahead. Bentley on Tuesday said its Bentayga SUV boosted the brand's performance in 2019 as it returned to profitability, while Rolls-Royce's Cullinan helped drive a 25% increase in sales to an all-time high of 5,152 vehicles. "Cullinan has proven to be an outstanding hot seller for the brand," Chief Executive Torsten Mueller-Oetvoes told Reuters. "We are sitting now on an order bank reaching even far into 2020." Aston hopes its first SUV, the DBX, will emulate this success and revive its fortunes next year. About 1,800 orders have been booked since its launch in November, the company said. "The order rate is materially better than any other car that we have ever launched before," Palmer told Reuters. For 2019, Aston expects adjusted earnings before interest, tax, depreciation and amortization (EBITDA) of 130-140 million pounds ($171 million to $184 million). The company reported 247.3 million pounds in core profit a year earlier, while analysts' average forecast was 196 million pounds for 2019, according to a company-compiled consensus. Aston said it was also in talks with investors for a potential equity investment and would draw down $100 million in bond notes. Its shares, which have lost nearly 3 billion pounds in market value since their listing, were down 11.1% to 464.8 pence at 1136 GMT. Â

2017 Aston Martin DB11 Prototype First Drive

Wed, May 4 2016Flashback: Geneva. The 2017 Aston Martin DB11 debuts, its artfully sculpted body signaling a departure from the brand's luscious yet familiar design language. But this time, the car in question is more than just a pretty face. Beneath the gently arced bonnet is the first turbocharged engine in the Aston's 103 year-old history. Gone is the so-called Vertical Horizontal architecture, replaced with a bonded aluminum chassis that's so new that it has yet to be graced with a catchy marketing name. Sumptuous interior? Check. Slick multimedia system? Finally. The quickest, fastest, and most powerful DB to date? Hell yes. With radical changes coming in hot from Gaydon, the DB11 isn't just an all-new car; it's nothing short of golden opportunity to reinvent the brand. There's so much new stuff in this DB9 replacement that the double integer leap in nomenclature seems justified (the DB10 was already taken by a certain spy from Blighty). In the grand scope of the Aston Martin lineup, the DB11 inherits the DB9's role as the archetypal grand touring car—elegant but quick, thirsty for miles. But as our wheel time revealed, it takes some time to comprehend the depth of the DB11 story. When you settle into the $211,995 Aston Martin DB11 there's a lot to take in, especially since our tester is a "verification prototype" that's two stages away from final production. Hence, the data logging equipment and big red fire suppression button. The engine has shrunk from 6.0-liters to 5.2, but now churns out 600 horsepower and a whopping 516 lb-ft of torque at only 1,500 rpm thanks to those turbos. Aston claims 0 to 62 mph in 3.9 seconds and a top speed of 200 mph. The rear double wishbone suspension has been replaced with a multilink setup for greater compliance, and the DB11 also gets Aston's first-ever torque vectoring (via brakes) and electronic power steering system. The prototype car is a visual paradox, with its camouflaged exterior contrasting with the delightfully gaudy baby blue leather interior (made from extra trimmings of hide). In terms of development, the car is about "85 percent there" according to Aston brass. Disclaimer: this car's traction control system is only about 70 percent complete, and the torque-vectoring feature isn't active on this particular car. The big V12 fires up with a full-sounding rush of exhaust, though the tone isn't quite as naughty or shrill as the old naturally aspirated mill.

Aston Martin CFO departs as stock hits a record low, losses deepen

Thu, Feb 27 2020LONDON — Aston Martin shares slumped to a record low on Thursday after the British luxury carmaker said its losses ballooned last year and its chief financial officer would leave by the end of April. The firm, famed for being fictional agent James Bond's car of choice, posted a pretax loss of 104 million pounds ($135 million) last year compared with 68 million pounds in 2018 following a 9% decline in sales to dealers. Aston Martin is in the midst of restructuring after announcing last month that a consortium led by Canadian billionaire Lawrence Stroll would buy up to 20% of the company and existing shareholders would inject more cash. Its shares, which were listed in October 2018, have been on a steady downward trajectory ever since and hit a record low of 328 pence following the announcements on Thursday, more than 80% lower than their flotation price. "The big difference between last year and this year is the strength of the balance sheet," Chief Executive Andy Palmer told Reuters. "We're in a very different place and have therefore an ability to properly ... destock and that means get the balance right between supply and demand." Chief Finance Officer Mark Wilson will step down from his role no later than April 30 but had not been fired, said Palmer. Coronavirus impact China, Aston's fastest growing market, was a rare bright spot last year with sales rising 28% but the company, like the rest of the industry, has seen demand drop due to the coronavirus outbreak. The virus has infected more than 80,000 people and killed about 2,800, the majority in China, confining millions to their homes, disrupting businesses and delaying the reopening of factories after the extended Lunar New Year holiday break. Aston has seen disruption to the arrival of certain parts but said it had not had to stop production at its factories, with components secured until at least the end of March because it has no direct suppliers in China. "Since almost the first weeks of the New Year we've had issues with those Tier 2 and Tier 3 (suppliers) which have meant that our supply chain guys have had to be on it constantly," said Palmer. "We're ironically benefitting from the fact that we built up a Brexit stock," he said, in a reference to extra components the firm held in case Britain's departure from the European Union led to additional delays in the movement of goods.