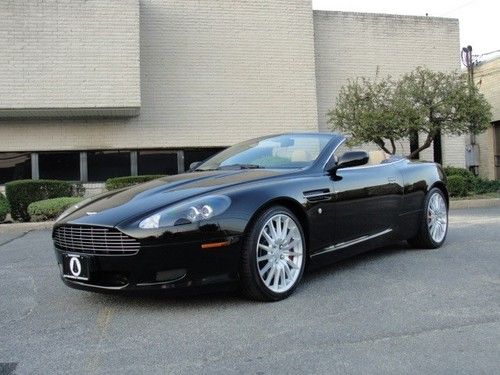

Stunning Db9 Convertible Service History 19 Whls Htd Seats Nav 5k Miles Pristine on 2040-cars

Marietta, Georgia, United States

For Sale By:Dealer

Engine:6.0L 5935CC V12 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Year: 2008

Make: Aston Martin

Model: DB9

Disability Equipped: No

Trim: Volante Convertible 2-Door

Doors: 2

Cab Type: Other

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 5,435

Number of Doors: 2

Sub Model: Volante

Exterior Color: Green

Number of Cylinders: 12

Interior Color: Tan

Aston Martin DB9 for Sale

2013 aston martin db9 b&o sound,piano black trim,upgrade alarm,sports seats,wow!(US $173,500.00)

2013 aston martin db9 b&o sound,piano black trim,upgrade alarm,sports seats,wow!(US $173,500.00) 05 db9-21k-linn 950w audio system-mahogany trim-heated seats-nav-cruise control(US $54,995.00)

05 db9-21k-linn 950w audio system-mahogany trim-heated seats-nav-cruise control(US $54,995.00) 2008 volante used 6l v12 48v automatic rear wheel drive convertible premium(US $83,850.00)

2008 volante used 6l v12 48v automatic rear wheel drive convertible premium(US $83,850.00) 2008 volante used 6l v12 48v automatic rear wheel drive convertible premium(US $83,850.00)

2008 volante used 6l v12 48v automatic rear wheel drive convertible premium(US $83,850.00) Coupe 6.0l nav cd locking/limited slip differential rear wheel drive cd changer(US $175,500.00)

Coupe 6.0l nav cd locking/limited slip differential rear wheel drive cd changer(US $175,500.00) 2006 aston martin db9 volante, one owner from new, warranty, loaded

2006 aston martin db9 volante, one owner from new, warranty, loaded

Auto Services in Georgia

Zbest Cars Atlanta ★★★★★

Zala 24-HR Plumbing ★★★★★

Yancey Tire & Auto Service ★★★★★

Wright`s Car Care Inc ★★★★★

Weaver Brake & Tire ★★★★★

Volvo Specialist ★★★★★

Auto blog

Aston Martin DBS GT Zagato previewed in renderings

Mon, Mar 25 2019Last fall, Aston Martin and Zagato announced that they would be building special continuation versions of the DB4 GT Zagato to celebrate the Italian design house's 100th anniversary. But the two companies wouldn't stop there, as each DB4 would come with an yet-to-be-revealed DBS variant. Now the companies have released detailed renderings and information about what is officially called the Aston Martin DBS GT Zagato. The car will be based on the hottest DB11 model, the DBS Superleggera. That means it should have a twin-turbo V12 making at least 715 horsepower and 664 pound-feet of torque with all of that going to the rear wheels through an eight-speed automatic. Outside of the bones, the DBS GT Zagato will have a thoroughly revised exterior. As shown in the photos, the front grille is one piece and is more reminiscent of what's found on the smaller Aston Martin Vantage. An exaggerated double-bubble roof is a highlight, and it stretches out to the pointy tip of the tail. The hood echoes the double bubble in its center. The taillights have an afterburner shape that Zagato has favored lately. Neither Aston nor Zagato has said when we'll see the actual car, but we expect it will be shown sometime this year. Buyers will start getting their DBS GT Zagatos at the end of 2020, a year after their DB4 GT Zagato continuation cars are delivered. As a reminder, the price for each of the 19 pairs of cars is 6 million pounds, or $7.93 million at current exchange rates and before taxes.

Driving the BMW M2 Competition, Honda Odyssey and Toyota RAV4 Prime | Autoblog Podcast #651

Fri, Oct 30 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick. This week, they talk about driving the BMW M2 Competition, Honda Odyssey and Toyota RAV4 Prime. Then they discuss James' experience testing the new Yakima CBX cargo carrier, Autoblog readers' preference for the GMC Hummer EV over the Tesla Cybertruck, and Mercedes-Benz taking a larger stake in Aston Martin. Lastly, they help James' father find a new car in the Spend My Money segment. Autoblog Podcast #651 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2020 BMW M2 Competition 2021 Honda Odyssey 2021 Toyota RAV4 Prime Testing the Yakima CBX Cargo Carrier on the Subaru Outback 75% of Autoblog Twitter follower prefer the GMC Hummer EV over the Tesla Cybertruck Mercedes-Benz to boost stake in Aston Martin to 20%, lend it some tech Spend JamesÂ’ fatherÂ’s money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Bond, junk bond? Aston Martin financial ratings go south as it awaits DBX

Sat, Sep 28 2019Ratings agencies Standard & Poor's and Moody's have taken a dim view of Aston Martin Lagonda. S&P cut its credit rating on the storied carmaker deeper into junk territory this week, and Moody's revised its credit outlook to "negative" after the company raised $150 million in debt from a bond issue at 12% interest, with the option to raise another $100 million at 15%. The Standard & Poor's rating was trimmed by one notch to 'CCC+', which reflects substantial risks and takes it close to default territory after a faster-than-expected cash burn this year. The outlook is negative. The negative outlook reflects ongoing pressure on profits, a high cash burn, and very high leverage in the face of heightened risks linked to a potential no-deal Brexit and new tariffs on car imports threatened by the United States. The potential salvation for the company is its new DBX luxury SUV, the success of which is critical to its ambitious growth strategy and ongoing creditworthiness, S&P said. But Moody's noted that it's burning cash at a high rate as it nears the launch of the DBX. The British carmaker, known as James Bond's favorite marque, has been hit by falling demand in Europe, the Middle East and Africa. It slumped to a first-half loss in July. Chief Executive Andy Palmer said concerns around Brexit and U.S.-China trade relations were skewing the outlook to the downside, so it was prudent to address investor concerns about its balance sheet. "Taking this debt on — short-term debt — is we think the correct tool to completely remove that thesis that we don't have sufficient liquidity," he told Reuters. "In every substantial and material way, this ensures that we can get through to DBX in spite of what all of those global uncertainties might throw at us." The main tranche comprises notes with an interest rate of 12% due in 2022, while the additional notes could be issued under the same terms if permitted, or could be issued as unsecured notes with an interest rate of 15%, Aston Martin said. Shares of stock in the company, which have had a precipitous fall since they listed in London in October 2018 at 19 pounds, were trading down 5% at 545 pence in early deals. Broker AJ Bell said Aston Martin was known for its high end prices and that situation now also applied to its debt. "These rates are very high and are a major red flag that investors consider the car company to be a high risk entity," it said.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.036 s, 7954 u