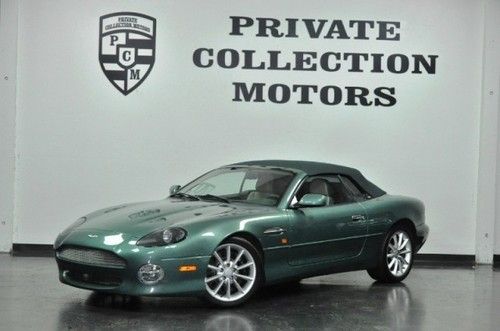

2002 Aston Martin Db7 Vantage* Low Miles* Spotless!!!! on 2040-cars

Costa Mesa, California, United States

Vehicle Title:Clear

Engine:6.0L 5935CC V12 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Make: Aston Martin

Warranty: Vehicle does NOT have an existing warranty

Model: DB7

Trim: Vantage Volante Convertible 2-Door

Number of doors: 2

Drivetrain: RWD

Drive Type: RWD

Mileage: 25,037

Number of Cylinders: 12

Exterior Color: Green

Interior Color: White

Aston Martin DB7 for Sale

Volante covertible with only 35k miles..southwest owned(US $34,900.00)

Volante covertible with only 35k miles..southwest owned(US $34,900.00) 2002 aston martin db7 v12 vantage coupe - no reserve!

2002 aston martin db7 v12 vantage coupe - no reserve! Stunning beautiful 1998 aston martin db7 covertible...only 33546 miles!(US $44,995.00)

Stunning beautiful 1998 aston martin db7 covertible...only 33546 miles!(US $44,995.00) 2002 aston martin db7 vantage volante convertible 2-door 6.0l(US $54,999.00)

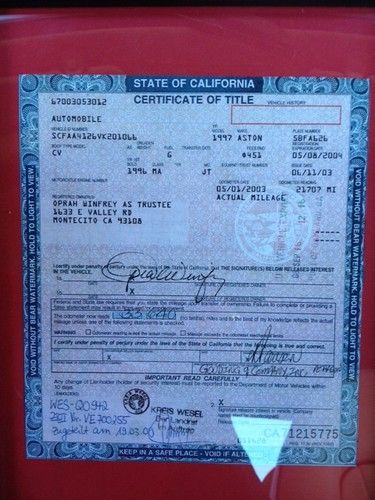

2002 aston martin db7 vantage volante convertible 2-door 6.0l(US $54,999.00) Oprah winfrey 1997 aston martin db7 volante convertable(US $199,999.00)

Oprah winfrey 1997 aston martin db7 volante convertable(US $199,999.00) Oprah winfrey 1997 aston martin db7 volante convertable(US $199,999.00)

Oprah winfrey 1997 aston martin db7 volante convertable(US $199,999.00)

Auto Services in California

Zoe Design Inc ★★★★★

Zee`s Smog Test Only Station ★★★★★

World Class Collision Ctr ★★★★★

WOOPY`S Auto Parts ★★★★★

William Michael Automotive ★★★★★

Will Tiesiera Ford Inc ★★★★★

Auto blog

Buy Sir Stirling Moss's '54 Aston Martin DB3S for just $10m

Mon, Apr 11 2016Bonhams estimates this rare 1954 Aston Martin DB3S will fetch as much as $10 million when it hits the auction block late next month. The fifth of 31 examples (and only 11 works racers) built, this particular DB3S was originally built for the private use of the company's owner David Brown. But after three other examples were destroyed at Le Mans in 1954, Brown handed his car over to the racing department, which replaced the fiberglass bodywork with aluminum and put it to work. Drivers like Sir Stirling Moss, Peter Collins, and Roy Salvadori drove it at Spa, the Nurburgring, and the Mille Miglia. As if that provenance weren't enough, the roadster then went on to appear in the '60s comedy School for Scoundrels alongside Ian Carmichael, Terry-Thomas, and Janette Scott – plus an Austin-Healey 100-Six and a 1928 Bentley 4 1/2 -Litre Open Tourer dubbed the "Swiftmobile." Bonhams has chassis number DBS3S/5 consigned for its upcoming sale at the old Aston Martin Works factory in Newport Pagnell. With all that history, the auction house anticipates it will sell for GBP6,000,000-7,000,000 – equivalent to $8.5-10 million at current exchange rates. That would, according to the records at Sports Car Market, make it one of the most valuable Astons ever sold at auction, besting the DB3S that Gooding & Company sold in 2014 for $5.5 million. Related Video: THE 1954 ASTON MARTIN DB3S: CAR OF THE SILVER SCREEN RACED BY THE GREAT STIRLING MOSS, NOW OFFERED AT BONHAMS A rare Aston Martin Works team car – chassis number DB3S/5 – which was campaigned in period by such legendary racing drivers as Sir Stirling Moss, Peter Collins and Roy Salvadori, and latterly went on to co-star with Terry-Thomas in 1960s movie classic 'School for Scoundrels', will be offered at Bonhams Aston Martin Works Sale on 21 May 2016. It is estimated at GBP6,000,000-7,000,000. This historic Aston Martin began life as the personal road car of David Brown, the multi-millionaire industrialist owner of the Aston Martin marque. Under Brown's reign the legendary post-World War 2 'DB' series of Aston Martin cars were built, including the Atom, the DB2, DB3, DB4, DB5, DB6, DB7, DB9 and the DBS, all named using Brown's initials. Aston Martin also built a number of DB3S models for the Works racing team.

Aston Martin DB5 hood used to make Atelier Jalaper watches

Sat, Aug 20 2022There are more than a few famous movie cars, like Eleanor, Doc's DMC-12, the Bandit's Trans-Am, and Bullitt's Mustang, for instance. There are hardly any movie cars that are famous, beautiful, and lustworthy, and that 60 years later are still having a moment. Consider that Aston Martin produced the DB5 from 1963 to 1965, sending only a touch more than 1,020 units into the world, but it seems like every six months we get a new take on either the car itself or something having to do with the car. Atelier Jalaper is the latest to make an entry in the latter category. Two gents got the idea to produce a watch using something from a historic car. After putting the Jaguar E-Type, AC Cobra, Ferrari F40, and Aston Martin DB5 donor cars up for vote on Instagram, the people chose Bond, and the results are the AJ-001 and AJ-002 watches. The journey started with a successful Kickstarter campaign, which was the easy part. With money in hand, it took the two men behind the company a year to find an authentic hood from an original DB5. To ensure provenance, Atelier Jalaper had Aston Martin Works verify the hood, a two-hour process that produced a 20-page report on the Silver Birch unit. The men then visited Switzerland to find the engineers and watch maker who could turn the metal into a timepiece. The engineering involved tasks like flattening the hood and removing the nine layers of paint while leaving the metalworking marks and patina of the raw steel, and a 58-minute-long process of lasering texture into the dial. The actual watch bits include a Miyota automatic movement visible though the clear back, numerals that resemble the odometer figures in the DB5, and a choice of two complications. The AJ-001 features the date, the AJ-002 features the day and date. Both are available in a polished steel case or a matte black PVD case. The series is limited to 600 units, each serial engraved into a button on the left side, and customers can choose a serial number if it hasn't been taken already. Prices start at ˆ800 ($814 U.S.) for the AJ-001 in stainless steel and go to ˆ1,150 ($1,170 U.S.) for the AJ-002 in black PVD.   Related video:

Lotus Esprit S1 gets wet and wild in 'Forza Horizon 4' James Bond trailer

Tue, Sep 18 2018It only makes sense. When the official trailer for Forza Horizon 4 ( FH4) first debuted at E3, details showed the game is set in Britain. Those who were ahead of the curve might have recognized this as a foreshadowing of sorts. Celebrating the launch of FH4's XBOX One and Windows 10 demo on Sept. 12, Playground Games announced that the next version of the beloved racing simulator will launch with an available Best of Bond pack that includes many of James Bond's storied rides. As expected, the list is heavy on the Aston Martin, but there are plenty of other goodies, too. Included in the 10-car pack are the 1964 Aston Martin DB5, a 1969 Aston Martin DBS, a 1986 Aston Martin V8, a 2008 Aston Martin DBS, a 2015 Aston Martin DB10, a 1974 AMC Hornet X Hatchback, a 1977 Lotus Esprit S1, a 1981 Citroen 2CV6, a 1999 BMW Z8, and a 2010 Jaguar C-X75. If you can name every movie that all of these vehicles are from, pat yourself on the back and grab a martini. View 15 Photos Microsoft is rewarding those who are all-in on FH4. The Best of Bond pack will come with the Ultimate Edition of the game that is allowed an early play date, starting Sept. 28. For those who haven't fully committed, the Best of Bond pack will be available as an add-on for purchase when the game launches globally on Oct. 2. The action-packed trailer shows many of the vehicles transforming or busting out tricks they're known for from the films, including the Lotus emerging from the sea. Although players will not be able to drive any vehicles under water (that we know of), several of the gadgets will make it into the game and will be viewable during Forzavista mode. The '64 DB5 has many of its features, such as the bumper rams and revolving license plate, while the Lotus will have an available body kit, fins and all. The Bond pack also comes with a few features irrelevant to the cars, including two Bond outfits and six "quick chat" phrases that can be used during multiplayer. The pack adds to an already impressive catalogue of vehicles that includes more than 450 different rides. Available now to pre-order, the FH4 Ultimate Edition is priced at $99.99, the Deluxe Edition is $79.99, while the base game is $59.99. For those who love Bond but don't own a gaming system, don't forget about the recently announced DB5 Lego kit.