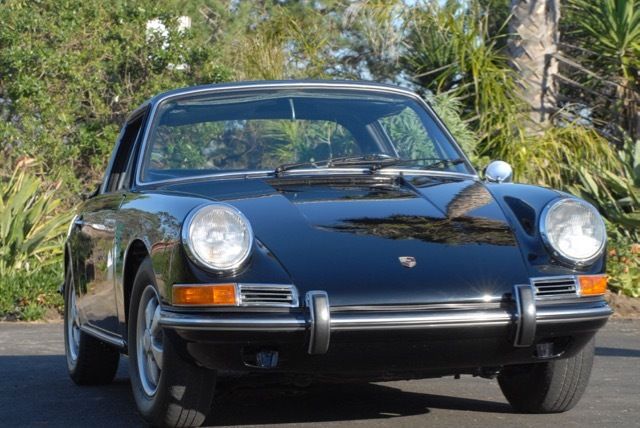

1968 Porsche 912 Soft Window Targa on 2040-cars

Rancho Santa Margarita, California, United States

For more details email me at: cary.steinhardt@clovermail.net .

1968 Soft Window Targa

new black paint with charcoal German carpet and black leather seats from Auto International of Escondido

5 Speed

rebuilt engine / Big Bore / # 752983

rebuilt carbs

new rubber, seals, and bushings

no rust

original floor pans

original rubber floor mats

Fuch alloy wheels

tonneau boot and bag

jack and lug wrench

removable hard top excellent original / new soft window

appointment available

Del Mar, CA

Porsche 912 for Sale

1976 porsche 912(US $9,300.00)

1976 porsche 912(US $9,300.00) 1968 porsche 912(US $11,000.00)

1968 porsche 912(US $11,000.00) 1969 porsche 912(US $27,200.00)

1969 porsche 912(US $27,200.00) 1966 pousche 912(US $29,000.00)

1966 pousche 912(US $29,000.00) 1966 porsche 912(US $17,900.00)

1966 porsche 912(US $17,900.00) 1969 porsche 912(US $12,900.00)

1969 porsche 912(US $12,900.00)

Auto Services in California

Young`s Automotive ★★★★★

Yas` Automotive ★★★★★

Wise Tire & Brake Co. Inc. ★★★★★

Wilson Motorsports ★★★★★

White Automotive ★★★★★

Wheeler`s Auto Service ★★★★★

Auto blog

$1.4B hedge fund suit against Porsche dismissed

Wed, 19 Mar 2014Investors have canvassed courts in Europe and the US to repeatedly sue Porsche over its failed attempt to take over Volkswagen in 2008 (see here, and here and here), and they have repeatedly failed to win any cases. You can add another big loss to the tally, with Bloomberg reporting that the Stuttgart Regional Court has dismissed a 1.4-billion euro ($1.95B US) lawsuit, the decision explained by the court's assertion that the investors would have lost on their short bets even if Porsche hadn't misled them.

Examining the hedge funds' motives for stock purchases and the bets that VW share prices would fall, judge Carola Wittig said that the funds didn't base their decisions on the key bits of "misinformation," and instead were participating simply in "highly speculative and naked short selling," only to get caught out.

With other cases still pending, the continued streak of victories bodes well for Porsche's courtroom fortunes, since judges will expect new information to consider overturning precedent. If there is any new info, it could come from the potential criminal cases still outstanding against former CEO Wendelin Wiedeking and CFO Holger Härter, who were both indicted on charges of market manipulation.

Porsche inspecting 2,500 Euro-spec Macans for damaged brake boosters

Thu, 29 May 2014Porsche is investigating a potential brake issue with 2,500 of its new Macan CUVs. The inspection focuses on the state of the brake systems following tests that discovered the brake boosters may have been damaged during assembly.

Porsche has pointed out that, despite the concern, the affected Macans still meet safety regulations. The issue is predominantly found in European-spec Macans, which according to Porsche, have been delivered to consumers. Owners of affected vehicles in Europe will be notified and asked to come in for a brief, no-cost inspection.

American consumers, though, have no reason to worry. We reached out to Porsche Cars North America, who confirmed that the vehicles in question were assembled before US-spec cars were screwed together.

Porsche board members facing another ˆ1.8B lawsuit over VW takeover bid

Mon, 03 Feb 2014Back in 2008, Porsche got the bright idea that it could take over Volkswagen in the midst of the worst economic slump since the Great Depression. Ignoring that this was a catastrophic move for the Stuttgart sports car manufacturer that that eventually resulted in it nearly going bankrupt and eventually being taken over by the same company it sought to control, the aftermath has left Porsche Chairman Wolfgang Porsche and board member Ferdinand Piëch in the crosshairs of seven hedge funds that lost out during the takeover and are now seeking €1.8 billion - $2.43 billion US - in damages from the two execs, according to the BBC.

See, investors bet on Volkswagen's share price going down, partially because Porsche said it wasn't going to attempt a takeover. But Porsche was attempting to take over VW, having bought up nearly 75-percent of VW's publicly traded shares. When word broke that Porsche owned nearly three-quarters of VW (which indicated an imminent takeover attempt), rather than go down like the hedge funds bet it would, VW's share price skyrocketed to over 1,000 euros per share, according to Reuters.

Naturally, when you bet that a company's share price is going to drop and it in turn (temporarily) becomes the world's most valuable company, you lose a lot of money, unless you're able to buy up shares before prices jump too much. This led to a squeeze on the stock, which the hedge funds accuse Porsche and Piëch (who are both members of the Porsche family and supervisory board) of organizing.