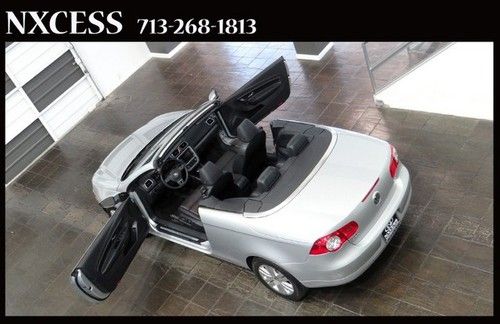

2010 Volkswagen Eos Komfort Convertible 2-door 2.0l on 2040-cars

Stamford, Connecticut, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:2.0L 1984CC 121Cu. In. l4 GAS DOHC Turbocharged

Fuel Type:GAS

For Sale By:Stamford Hyundai

Make: Volkswagen

Model: Eos

Trim: Komfort Convertible 2-Door

Options: Sunroof, Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 65,767

Exterior Color: Silver

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 4

Volkswagen Eos for Sale

2007 volkswagen eos 2.0t convertible 2-door 2.0l(US $8,900.00)

2007 volkswagen eos 2.0t convertible 2-door 2.0l(US $8,900.00) 2010 vw eos komfort (2dr conv dsg komfort sulev) turbo 2l i4 16v automatic fwd(US $21,973.00)

2010 vw eos komfort (2dr conv dsg komfort sulev) turbo 2l i4 16v automatic fwd(US $21,973.00) 2009 volkswagen eos lux convertible 2-door 2.0l with over $20k in upgrades

2009 volkswagen eos lux convertible 2-door 2.0l with over $20k in upgrades Clean carfax warranty dealer inspected automatic

Clean carfax warranty dealer inspected automatic 2008 volkswagen eos turbo convertible 2-door 2.0l

2008 volkswagen eos turbo convertible 2-door 2.0l Komfort convertible auto heated seats warranty!!!(US $19,850.00)

Komfort convertible auto heated seats warranty!!!(US $19,850.00)

Auto Services in Connecticut

Warburtons Automobile Repair ★★★★★

Vail Buick GMC ★★★★★

Saf-T Auto Ctr ★★★★★

Ren Sales & Svc ★★★★★

Pop`s Exhaust ★★★★★

Paul`s Automotive ★★★★★

Auto blog

How VW's hyper-efficient XL1 will influence the next Golf

Mon, 18 Aug 2014In 2007, the European Union mandated fleet average CO2 emissions of 158.7 g/km. For 2015, that figure will drop to 130 g/km, and the target for 2020 is an ambitions 95 g/km. Thanks to some German politicking, that target will be phased in from 2020 to 2024, but it will still apply to 80 percent of passenger cars in that first year. In US miles per gallon, that's the equivalent of going from about 35 mpg to 42 mpg to 57 mpg. The current Volkswagen Golf is rated from 85 g/km of CO2 to 190 g/km depending on model - and zero for the e-Golf, so for the next-generation MkVIII hatch due in 2019, to meet the goal, Volkswagen engineers will need to introduce a bunch of new tricks. According to a report in Autocar, VW be mining its hyper-efficient XL1 for some of them.

Predictions for the next Golf include a variable-compression engine, an electric flywheel and an electric turbo, along with taking greater advantage of coasting. Volkswagen could be getting help from Audi with the electric turbo and variable-compression engine and electric turbo, with Audi already having shown off the former and brand technical boss Ulrich Hackenberg confirming the VW Group is working on the latter. It's possible the flywheel system could also have the mark of The Four Rings: Autocar mentions a British system that Volvo is testing, but the R18 e-tron Quattro racer has been using one for years.

The need for such features is because the company won't be able to net enough future gains from just aerodynamic improvements and advanced materials. As price will be a factor (the regulations are expected to "add hundreds of euros to the cost of building a car"), adding much more aluminum or carbon fiber is an unlikely option. We're told the next generation won't be longer or wider than the current car, and being Europe's most popular model, VW doesn't want to make a big bet on futuristic aero, but the report says the MkVIII will "likely" have "the most aerodynamic treatment yet seen on a production vehicle," the area where lessons learned from the XL1 will truly be seen.

VW pondering low-cost sub-brand for China?

Wed, 30 Jan 2013More detail is being sketched into the Volkswagen Group's plan to launch a low-cost brand for emerging markets. Late last year a German report quoted a VW rep saying that the brand has been interested in building a no-frills car, the kind that would challenge Dacia and Datsun, for a while. With both Proton and Suzuki effectively out of the partnership picture, a report in Reuters suggests VW could go straight to China, developing a car with its joint venture partners and building and selling it there.

Officially, company CEO Martin Winterkorn said the issue of a model for emerging markets would be decided this year but VW isn't any closer to confirming any kind of plan for a car in its portfolio underneath the Up!, remarking to Reuters about the China possibility, "That's an issue we're currently looking at."

VW makes $9.2B offer for rest of truckmaker Scania

Sun, 23 Feb 2014Volkswagen owns or has controlling interests in three commercial truck operations: besides its own, VW began buying shares in Sweden's Scania in 2000 and now controls 89.2 percent of its shares and 62.6 percent of its capital, then bought into Germany's Man in 2006 - in order to prevent Man from trying to take over Scania - and now owns 75 percent of it. The car company has managed to work out 200 million euros in savings, but believes it can unlock a total of 650 million euros in savings if it takes outright control of Scania and can spread more common parts among the three divisions.

It has proposed a 6.7-billion-euro ($9.2 billion) buyout, but according to a Bloomberg report, Scania's minority investors don't appear inclined to the deal. Although effectively controlled by VW, Scania is an independently-listed Swedish company, and a profitable one at that: in the January-September 2013 period its operating profit was 9.4 percent compared to Man's 0.4 percent. Some of the other shareholders believe that Scania is better off on its own and will not approve the deal, some have asked an auditor to look into the potential conflict of interest between VW and Man, while some are willing to examine the deal and "make an evaluation based on what a long-term owner finds is good," which might not be just "the stock market price plus a few percent." The buyout will only be official assuming VW can reach the 90-percent share threshold that Swedish law mandates for a squeeze-out.

Many of the arguments against boil down to investors believing that Scania's Swedishness and unique offerings are what keep it profitable, and ownership by the German car company will kill that. (Have we heard that somewhere before?) If Volkswagen can buy that additional 0.8-percent share in Scania, perhaps its buyout wrangling with Man will give it an idea of what it's in for: "dozens" of minority investors in the German truckmaker have filed cases against VW, seeking higher prices for their shares. It is likely only to delay the inevitable, though. If VW is really going to compete with Daimler and Volvo in the truck market, it has to get the size, clout and savings to do so.