Volkswagen : Bus/vanagon Sundail Camper on 2040-cars

Westminster, California, United States

|

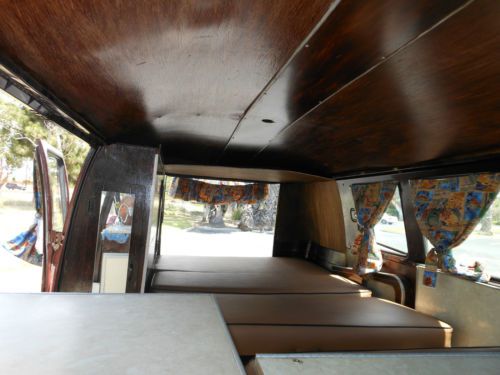

All 4 New Brakes New Master Cyclinder All 4 New Wheels Cyclinder New Upholstery Hardwood Floor Orginal California Bus with CA Black plate 1962 Sundail Camper |

Volkswagen Bus/Vanagon for Sale

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Porsche again staring down another $1.8B in hedge fund lawsuits

Wed, 15 May 2013The sequence of events from 2007 that began with Porsche's secret attempt to take over Volkswagen, and instead lead to Porsche being taken over by VW, continues to instigate lawsuits against the Stuttgart sports car manufacturer. A group of hedge funds that suffered over $1 billion in losses sued the car company in New York. Porsche had publicly stated it wasn't trying to buy VW, the hedge funds in question were shorting VW stock, and when Porsche's actual intentions were revealed, the stock shot up and the hedge funds took a beating.

The case was thrown out over the issue of jurisdiction, then appealed, only to see another suit filed on top of that. After that, most of the hedge funds withdrew their claims in New York and Porsche offered a 90-day window to refile in Germany where it is already fighting a number of other suits over the same issue. The hedge funds accepted the offer, refiling in Stuttgart for $1.8 billion in damages. According to Bloomberg, Porsche hasn't commented on the refiling, but as the same plaintiffs are involved, it's safe to assume that the carmaker still feels the case is "unsubstantiated and without merit." It has fared alright so far even in German courts, with two lesser cases against it thrown out last year.

VW makes $9.2B offer for rest of truckmaker Scania

Sun, 23 Feb 2014Volkswagen owns or has controlling interests in three commercial truck operations: besides its own, VW began buying shares in Sweden's Scania in 2000 and now controls 89.2 percent of its shares and 62.6 percent of its capital, then bought into Germany's Man in 2006 - in order to prevent Man from trying to take over Scania - and now owns 75 percent of it. The car company has managed to work out 200 million euros in savings, but believes it can unlock a total of 650 million euros in savings if it takes outright control of Scania and can spread more common parts among the three divisions.

It has proposed a 6.7-billion-euro ($9.2 billion) buyout, but according to a Bloomberg report, Scania's minority investors don't appear inclined to the deal. Although effectively controlled by VW, Scania is an independently-listed Swedish company, and a profitable one at that: in the January-September 2013 period its operating profit was 9.4 percent compared to Man's 0.4 percent. Some of the other shareholders believe that Scania is better off on its own and will not approve the deal, some have asked an auditor to look into the potential conflict of interest between VW and Man, while some are willing to examine the deal and "make an evaluation based on what a long-term owner finds is good," which might not be just "the stock market price plus a few percent." The buyout will only be official assuming VW can reach the 90-percent share threshold that Swedish law mandates for a squeeze-out.

Many of the arguments against boil down to investors believing that Scania's Swedishness and unique offerings are what keep it profitable, and ownership by the German car company will kill that. (Have we heard that somewhere before?) If Volkswagen can buy that additional 0.8-percent share in Scania, perhaps its buyout wrangling with Man will give it an idea of what it's in for: "dozens" of minority investors in the German truckmaker have filed cases against VW, seeking higher prices for their shares. It is likely only to delay the inevitable, though. If VW is really going to compete with Daimler and Volvo in the truck market, it has to get the size, clout and savings to do so.

Volkswagen throws a Polo-palooza with four new or upgraded models

Wed, 05 Mar 2014Volkswagen unveiled a parade of new and upgraded Polo models at the 2014 Geneva Motor Show, including the Polo TSI BlueMotion, Polo TDI BlueMotion, Polo BlueGT and CrossPolo (pictured above). While they will likely never make an appearance this side of the pond, it is fun to see what European subcompact drivers will be driving later this year.

The new BlueMotion models represent the most efficient petrol and diesel options in their class, according to VW. The BlueMotion TDI offers just 73 horsepower from its diesel engine but gives the equivalent of 76 miles per gallon (US) in the EU test. The BlueMotion TSI brings a little more power with its 88-hp petrol engine and has a combined rating of 57 mpg (US) in the EU cycle.

The Polo BlueGT provides a balance of performance and economy, and for the 2014 model, it gains a 9-horsepower boost to its 1.4-liter turbocharged to give drivers 147 hp at the press of the accelerator. This year's car also has an optional Sport Select suspension with electronically controlled dampers to improve handling a bit. It's still fitted with active cylinder management to use as little gas as possible when cruising.

Restored deluxe microbus 23-window 1600 cc 4 speed

Restored deluxe microbus 23-window 1600 cc 4 speed 1973 baywindow bus

1973 baywindow bus 1957 vw single cab

1957 vw single cab Vw volkswagen riviera pop-top camper bus 1966

Vw volkswagen riviera pop-top camper bus 1966 Vw bus deluxe 13 window

Vw bus deluxe 13 window Best in show westfalia automatic, a/c recaro new gowesty motor w/46k mi warranty

Best in show westfalia automatic, a/c recaro new gowesty motor w/46k mi warranty