1999 Carrera 4 Used 3.4l H6 24v Manual Convertible on 2040-cars

Barrington, Rhode Island, United States

Engine:6 Cyl

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Interior Color: Red

Make: Porsche

Number of Cylinders: 6

Model: 911

Drive Type: All Wheel Drive

Warranty: No

Mileage: 77,625

Sub Model: Carrera 4

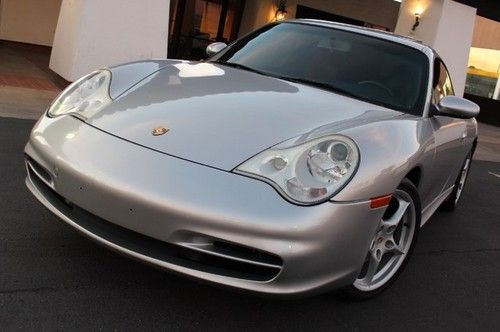

Exterior Color: Silver

Porsche 911 for Sale

Garage kept c4s cabriolet pdk huge options with upgrades from techart only 15k m(US $87,900.00)

Garage kept c4s cabriolet pdk huge options with upgrades from techart only 15k m(US $87,900.00) 2002 porsche 911 996 carrera cabriolet perfect

2002 porsche 911 996 carrera cabriolet perfect 2010 porsche 911 carrera cabriolet 345hp factory warranty navi! heated seats!!!(US $64,995.00)

2010 porsche 911 carrera cabriolet 345hp factory warranty navi! heated seats!!!(US $64,995.00) 2004 porsche 996/911 couple. 6 sp. sport seats. clean. bose sound. clean carfax(US $28,898.00)

2004 porsche 996/911 couple. 6 sp. sport seats. clean. bose sound. clean carfax(US $28,898.00) 2002 porsche 911 carrera **no reserve** 6spd 996 silver/blk leather turbo bumper

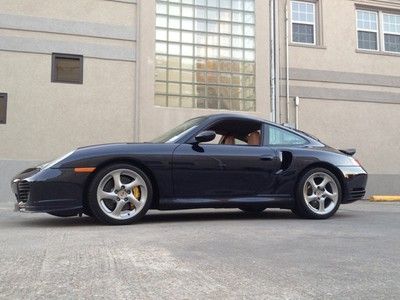

2002 porsche 911 carrera **no reserve** 6spd 996 silver/blk leather turbo bumper Porsche 996 twin turbo s mint !! 147k msrp heavily optioned 15k in options

Porsche 996 twin turbo s mint !! 147k msrp heavily optioned 15k in options

Auto Services in Rhode Island

Ziggy`s Auto SVC ★★★★★

Suburban Auto Technicians ★★★★★

Sparky`s ★★★★★

Plains Automotive ★★★★★

Majestic Honda ★★★★★

Ed`s Auto ★★★★★

Auto blog

Porsche 911 RSR in bizarre, terrifying rally crash

Sun, 22 Sep 2013As far as rally crashes go, this one is pretty terrifying. At this month's Hellendoorn Rally, Harry Kleinjan failed to negotiate a turn and drove his Porsche 911 RSR straight into a Jersey barrier, flipping the car into the river.

While it's unclear what caused the accident, German Car Scene notes, "We can see his brakes locking up ahead of the impact, which also ripped both driver's side wheels off, so it may be a case of ill-judged late braking, locking brakes or a jammed throttle." Us? We're betting it might have been bad pace notes. Fortunately for Harry and his co-driver, all indications are that no one was hurt. Check out the videos below to see the spectacular crash for yourself.

Watch a Porsche 918 Spyder being built by hand

Sat, Jan 3 2015No music track, no dialogue, no voiceover, just a group of women and men in a very clean room in Zuffenhausen assembling the Porsche 918 Spyder. It's the antidote to the adrenaline that the open-topped hybrid coupe encourages in most enthusiast bloodstreams, but this nearly-11-minute video is the most captivating B-roll we've seen in a while. From hand-sewn leather to hand-wrapped trim, monococques being wheeled about, the copious use of shims and the rear brace being fitted over the engine, plus the Christmas-like joy of opening a box of body panels, it's all in there. You can't buy a new one anymore, but you can see how they're built for those who did buy them in the video above. Related Gallery 2015 Porsche 918 Spyder: First Drive View 51 Photos Related Gallery 2015 Porsche 918 Spyder Factory Tour View 28 Photos News Source: Cars via YouTube, Road & TrackImage Credit: Copyright 2014 Michael Harley / AOL Green Plants/Manufacturing Porsche Convertible Hybrid Luxury Performance Supercars Videos porsche 918 spyder zuffenhausen

Fastest and most powerful SUVs in America for 2022

Wed, Nov 10 2021Here in the United States, we enjoy power almost as much as we like our SUVs. Thankfully, we’ve got plenty of both. Traditionally, the most powerful SUVs source their massive horsepower and torque from some form of a V8. While thatÂ’s still generally the case, electrification comes into play more and more, whether itÂ’s mild-hybrid tech, a plug-in hybrid powertrain or, as is the case with the two vehicles topping this list, fully electric vehicles. As we enter the 2022 model year, letÂ’s look at the most powerful SUVs available. Before we dive in, letÂ’s address the elephant that is waiting just outside the door. Due to supply shortages, Mercedes-Benz is shelving most V8 models for the 2022 model year. Some 2021 models can still be found in dealer inventories, but we wonÂ’t include them. With that in mind, letÂ’s dive into the list. 2022 Audi RS Q8 — 591 hp / 190 mph Read our review of the Audi RS Q8 The only Audi on this list is a hot little number, which we characterized as “an uncompromising option in a field of compromised options.” Powered by a 4.0-liter twin-turbo V8 (which seems to be a popular format in this list), its 591 hp and 590 lb-ft of torque get it scootinÂ’ to 60 mph in just 3.7 seconds, and on to a top speed of 190 mph. It even has the bragging rights of holding the Nurburgring lap record for an SUV.  2022 Rolls-Royce Cullinan Black Badge — 592 hp / 155 mph (limited) Read our review of the Rolls-Royce Cullinan This is one SUV where being a passenger might be more exciting than sitting in the driverÂ’s seat, thanks to over-the-top luxury — what do you expect from a car that costs over $350,000? The driver doesnÂ’t go unrewarded, though, with a turbocharged 6.75-liter V12 at their disposal. Thanks to the Black BadgeÂ’s software upgrade, it makes 592 hp and 664 lb-ft of torque to help get to its electronically limited top speed of 155 mph that much quicker.  2022 BMW Alpina XB7 — 612 hp / 180 mph Read our review of the BMW Alpina XB7 Alpina takes already impressive BMW vehicles and turns them into even more powerful, more luxurious machines. The Alpina XB7 improves upon the BMW X7 with a biturbocharged 4.4-liter V8 offering up 612 hp and 590 lb-ft of torque. ThatÂ’s good for a 4.0-second 0-60 sprint and a 180-mph top speed. Alpina also adds its own transmission and drivetrain tuning, upgraded suspension, exhaust and a whole slew of unique appearance touches.