2000 Brown Limited - Financing Available! on 2040-cars

Kansas City, Missouri, United States

Body Type:SUV

Engine:4.7L (287) SOHC SMFI V8 "POWER TECH" ENGINE

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

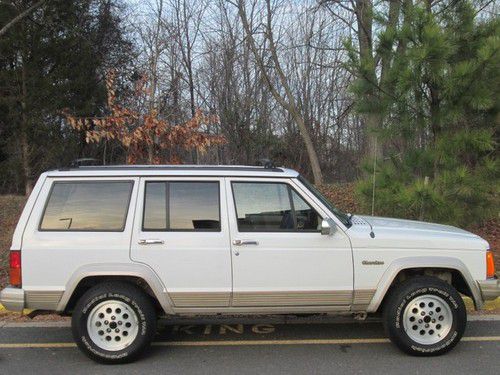

Make: Jeep

Model: Cherokee

Mileage: 156,623

Sub Model: Limited - FINANCING AVAILABLE

Exterior Color: Brown

Number of Doors: 4 doors

Interior Color: Black

Drivetrain: 4 Wheel Drive

Jeep Cherokee for Sale

Jeep cherokee(US $2,500.00)

Jeep cherokee(US $2,500.00) 1995 jeep country cherokee 4x4, leather, clean,carfx certified, loaded(US $3,923.00)

1995 jeep country cherokee 4x4, leather, clean,carfx certified, loaded(US $3,923.00) L@@k jeep cherokee with western 6.6 power angle plow in nj(US $1,950.00)

L@@k jeep cherokee with western 6.6 power angle plow in nj(US $1,950.00) 2012 jeep grand cherokee 4x4 altitude limited edition 3.6 l v-6(US $34,000.00)

2012 jeep grand cherokee 4x4 altitude limited edition 3.6 l v-6(US $34,000.00) 1979 jeep cherokee chief(US $6,000.00)

1979 jeep cherokee chief(US $6,000.00) 1999 jeep cherokee sport sport utility 4-door 4.0l

1999 jeep cherokee sport sport utility 4-door 4.0l

Auto Services in Missouri

Westport Service Center ★★★★★

Sterling Ave Auto Service ★★★★★

Santa Fe Glass Co Inc ★★★★★

Osage Auto Body ★★★★★

North West Auto Body & Service ★★★★★

Napa Auto Parts - Horn`S Auto Supply ★★★★★

Auto blog

Europe gets Jeep Wrangler Polar limited edition

Wed, 04 Sep 2013Jeep will be bringing an all-new, limited-edition model to the European market called the Wrangler Polar. Based on the Wrangler Sahara and set to make its debut at the 2013 Frankfurt Motor Show, the Wrangler Polar sports new Hyrdro Blue paint, gloss black 18-inch wheels, a body-color hardtop, and the regular mix of Mopar styling accessories. Billet Silver Metallic and Bright White are available for those that don't dig the glossy blue, while a two-door variant will be available in addition to the four-door pictured above.

The Polar's interior features similar tweaks; Pearl White contrast stitching can be found on both the seats and steering wheel, while ceramic White bezels and other accents give a nice contrasting look to the cabin.

Underhood sits an engine that should make American Wrangler enthusiasts weep - a 2.8-liter, four-cylinder turbodiesel. With 200 horsepower and 339 pound-feet of torque channeled through a five-speed automatic transmission, the Wrangler Polar should handle itself just fine on normal roads. British buyers will also be able to select the 3.6-liter Pentastar V6. For rougher stuff, Dana axles can be found front and rear (Dana 30 up front and Dana 44 in back), while the Command-Trac four-wheel-drive system and its two-speed transfer case should be enough for when the roads disappear.

China-FCA merger could be a win-win for everyone but politicians

Tue, Aug 15 2017NEW YORK — Fiat Chrysler boss Sergio Marchionne has said the car industry needs to come together, cut costs and stop incinerating capital. So far, his words have mostly fallen on deaf ears among competitors in Europe and North America. But it appears Marchionne has finally found a receptive audience — in China. FCA shares soared Monday after trade publication Automotive News reported the $18 billion Italian-American conglomerate controlled by the Agnelli family rebuffed a takeover from an unidentified carmaker from the Chinese mainland. As ugly as the politics of such a combination may appear at first blush, a transaction could stack up industrially, and perhaps even financially. A Sino-U.S.-European merger would create the first truly global auto group. That could push consolidation to the next level elsewhere. Moreover, China is the world's top market for the SUVs that Jeep effectively invented, so it might benefit FCA financially. A combo would certainly help upgrade the domestic manufacturer; Chinese carmakers have gotten better at making cars, but struggle to build global brands, and they need to develop export markets. Though frivolous overseas shopping excursions by Chinese enterprises are being reined in by Beijing, acquisitions that support the modernization and transformation of strategic industries still receive support, and the government considers the automotive industry to be strategic. A purchase of FCA by Guangzhou Automobile, Great Wall or Dongfeng Motors would probably get the same stamp of approval ChemChina was given for its $43 billion takeover of Syngenta. What's standing in the way? Apart from price (Automotive News said FCA's board deemed the offer insufficient) there's the not-insignificant matter of politics. Even as FCA shares soared, President Donald Trump interrupted his vacation to instruct the U.S. Trade Representative to look into whether to investigate China's trade policies on intellectual property. Seeing storied Detroit brands like Jeep, Chrysler, Ram and Dodge handed off to a Chinese company would provoke howls among Trump's economic-nationalist supporters. It might not play well in Italy, either, to see Alfa Romeo and Maserati answering to Wuhan instead of Turin — though Automotive News said they might be spun off separately. Yet, as Morgan Stanley observes, "cars don't ship across oceans easily," and political considerations increasingly demand local manufacture of valuable products.

Jeep: Beautiful Lands

Mon, Feb 2 2015Jeep emphasized the global nature of its all-new Renegade in a 90-second spot during the 2015 Super Bowl. Starting out in America, and with This Land is Your Land playing in the background, the spot splices images of the all-new Renegade with scenery from across the United States. As a global product and the first Jeep built outside the US, though, the spot quickly moves beyond America's borders, showing Renegades, people and scenery from around the globe. As for the Renegade, you can read all about it in our First Drive.