2013 Leather Heated Rear Dvd V6 Lifetime Warranty We Finance 17k Miles on 2040-cars

Vernon, Texas, United States

Chrysler Town & Country for Sale

2000 chrysler town & country van(US $1,500.00)

2000 chrysler town & country van(US $1,500.00) 1-owner 104k miles, no repairs needed, great family transporter(US $4,900.00)

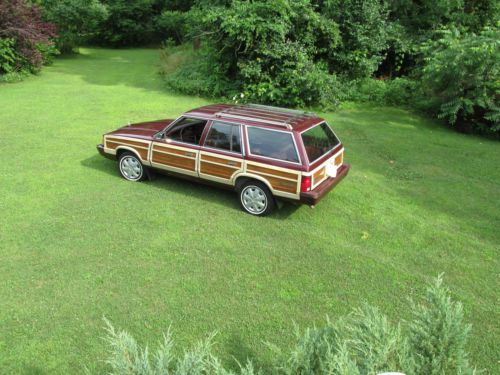

1-owner 104k miles, no repairs needed, great family transporter(US $4,900.00) 1987 chrysler town & country - woody wagon - with 43,100 original miles(US $3,800.00)

1987 chrysler town & country - woody wagon - with 43,100 original miles(US $3,800.00) 1948 chrysler town and country roadster clone(US $25,500.00)

1948 chrysler town and country roadster clone(US $25,500.00) 2006 chrysler town & country touring wheelchair handicap mobility van conversion(US $17,900.00)

2006 chrysler town & country touring wheelchair handicap mobility van conversion(US $17,900.00) 2005 town and country(US $7,599.00)

2005 town and country(US $7,599.00)

Auto Services in Texas

Xtreme Customs Body and Paint ★★★★★

Woodard Paint & Body ★★★★★

Whitlock Auto Kare & Sale ★★★★★

Wesley Chitty Garage-Body Shop ★★★★★

Weathersbee Electric Co ★★★★★

Wayside Radiator Inc ★★★★★

Auto blog

Court ruling to delay Fiat's Chrysler buyout?

Thu, 01 Aug 2013We've already reported on the attempts of Fiat to purchase the remaining 41.5-percent stake in Chrysler, currently owned by the United Auto Workers' VEBA healthcare trust. And while the issues still aren't resolved, Fiat has received both a bit of good news and a bit of bad news from a Delaware judge.

The good news is that the court ruled in favor on two key arguments of Fiat's, relating to what is a fair price for the Chrysler shares. The rulings essentially slash half a billion dollars off the price of the 54,000 shares owned by VEBA, according to a report from Reuters.

The bad news is that this makes the UAW an even more difficult opponent in negotiations. Its VEBA fund is meant to cover ever escalating retiree healthcare costs, so naturally, the UAW wants to get as much money as possible. Losing a big chunk of cash isn't likely to make the union more cooperative.

Fiat ups Chrysler stake by 3.3%, inches closer to full control

Mon, 08 Jul 2013Fiat is one step closer to completing a merger with Chrysler after exercising an option to acquire an additional 3.3 percent of the Auburn Hills-based automaker today. Automotive News reports that Fiat now controls 68.49-percent of Chrysler, which is up almost 10 percent since we last heard news of this deal back in February when Fiat talking to various banks to raise more capital in order to complete the acquisition.

The article says that Fiat is still able to increase its stake in Chrysler up to 75 percent over the next 12 months, but it sounds like CEO Sergio Marchinonne would rather purchase the remaining shares from VEBA - the retiree benefits trust - sooner rather than later. Unfortunately, the two sides still seem far from an agreement on a fair price for the rest of Chrysler, as Fiat has them valued at $4.2 billion compared to the $10.3 billion estimate from the unions that currently own the remaining stake in Chrysler.

Move over Audi, now Chrysler has a beef with Tesla's claims

Thu, 23 May 2013In the same week that Audi said "not so fast" to some claims from Tesla, Chrysler has responded to a new press release from the California-based EV-maker by saying "not exactly, Tesla." The statement, released through the company's blog, comes in response to Tesla claiming it was "the only American car company to have fully repaid the government." Chrysler notes that it, too, recently paid back Uncle Sam from its 2008 bailout. Similar to Audi's recent press release, which was eventually and mysteriously deleted from the German automaker's site, Chrysler is both right and wrong in its statement.

Tesla specifically said that it had paid back the Department of Energy loans that many automakers received - including Fisker and VPG Autos - while Chrysler's retort argues Tesla is "unmistakably incorrect" since it repaid the government in 2011 a full six years early. Technically, the statements from both automakers are correct, but Tesla's startup loan originated from the DoE, while Chrysler's loan came in bailout form from the Troubled Asset Relief Program (TARP). Further, as The Detroit News notes, Chrysler's loan still cost taxpayers well over a billion dollars after all was said and done - those negative assets tied to "old Chrysler" in the bankruptcy did not require repayment.