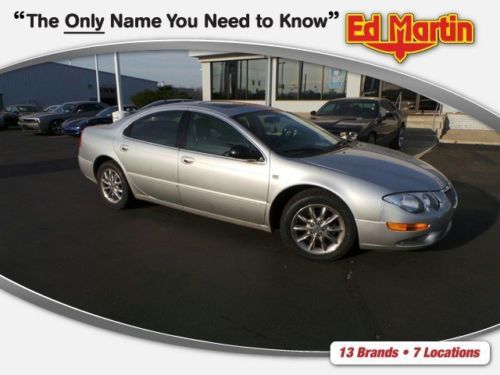

2002 Chrysler Pt Cruiser Limited Wagon 4-door 2.4l on 2040-cars

Lakeland, Florida, United States

|

2002 Chrysler PT Cruiser Limited Edition PW , PL , Sunroof , Leather Interior , A/C , Radio AM/FM CD , Cruise Control. Vehicle is in Great Conditions real Clean!! Price does not include, tax , tag , title or dealer fee. Please check our other listings.

|

Chrysler 200 Series for Sale

2005 chrysler 300 touring silver, excellent condition

2005 chrysler 300 touring silver, excellent condition 2013 chrysler 300c john varvatos limited edition phantom black $11500 off!!(US $42,320.00)

2013 chrysler 300c john varvatos limited edition phantom black $11500 off!!(US $42,320.00) 2006 limited used 3.2l v6 18v automatic rwd convertible premium(US $12,891.00)

2006 limited used 3.2l v6 18v automatic rwd convertible premium(US $12,891.00) Very cool 1969 chrysler 300 convertible. the car definitely has a cool factor

Very cool 1969 chrysler 300 convertible. the car definitely has a cool factor Base 3.5l cd front wheel drive leather moonroof automatic power windows locks

Base 3.5l cd front wheel drive leather moonroof automatic power windows locks 2006 chrysler touring 300 series black stretch limo(US $40,000.00)

2006 chrysler touring 300 series black stretch limo(US $40,000.00)

Auto Services in Florida

Youngs` Automotive Service ★★★★★

Winner Auto Center Inc ★★★★★

Vehicles Four Sale Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Auto Glass ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Fiat ups Chrysler stake by 3.3%, inches closer to full control

Mon, 08 Jul 2013Fiat is one step closer to completing a merger with Chrysler after exercising an option to acquire an additional 3.3 percent of the Auburn Hills-based automaker today. Automotive News reports that Fiat now controls 68.49-percent of Chrysler, which is up almost 10 percent since we last heard news of this deal back in February when Fiat talking to various banks to raise more capital in order to complete the acquisition.

The article says that Fiat is still able to increase its stake in Chrysler up to 75 percent over the next 12 months, but it sounds like CEO Sergio Marchinonne would rather purchase the remaining shares from VEBA - the retiree benefits trust - sooner rather than later. Unfortunately, the two sides still seem far from an agreement on a fair price for the rest of Chrysler, as Fiat has them valued at $4.2 billion compared to the $10.3 billion estimate from the unions that currently own the remaining stake in Chrysler.

These cars are headed to the Great Crusher In The Sky

Fri, 24 Aug 2012It happens every year. We bid adieu to some cars and trucks that will be missed, and say good riddance to others wondering how they stayed around so long. Whether they're being killed off for slow sales or due to a new product coming along to replace them, the list of vehicles being discontinued after 2012 is surprisingly long and diverse.

CNN Money has compiled a list of departing vehicles, to which we've added a few more of our own. In the slow sales column, cars like the Lexus HS 250h, Mercedes-Benz R-Class and the full Maybach lineup appear, while the Ford Escape Hybrid, Mazda CX-7 and Hyundai Veracruz are all having their gaps filled with more modern and more fuel-efficient alternatives. Obvious exceptions to the rule include models that still sell in decent numbers like the Jeep Liberty and the Chrysler Town & Country (which will eventually be replaced by a crossover-like vehicle).

Check out our gallery of discontinued cars above, then scroll down for more information.

Court ruling to delay Fiat's Chrysler buyout?

Thu, 01 Aug 2013We've already reported on the attempts of Fiat to purchase the remaining 41.5-percent stake in Chrysler, currently owned by the United Auto Workers' VEBA healthcare trust. And while the issues still aren't resolved, Fiat has received both a bit of good news and a bit of bad news from a Delaware judge.

The good news is that the court ruled in favor on two key arguments of Fiat's, relating to what is a fair price for the Chrysler shares. The rulings essentially slash half a billion dollars off the price of the 54,000 shares owned by VEBA, according to a report from Reuters.

The bad news is that this makes the UAW an even more difficult opponent in negotiations. Its VEBA fund is meant to cover ever escalating retiree healthcare costs, so naturally, the UAW wants to get as much money as possible. Losing a big chunk of cash isn't likely to make the union more cooperative.