Blue Gray Interior 5 Speed Manual Transmission Clean Cruise Keyless Entry Carfax on 2040-cars

Seymour, Indiana, United States

Vehicle Title:Clear

Engine:2.2L 2198CC 134Cu. In. l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Fuel Type:GAS

Make: Chevrolet

Warranty: Vehicle does NOT have an existing warranty

Model: Cobalt

Trim: LT Sedan 4-Door

Options: Sunroof

Power Options: Power Locks

Drive Type: FWD

Mileage: 41,794

Number of Doors: 4

Sub Model: 4dr Sdn LT w

Exterior Color: Blue

Number of Cylinders: 4

Interior Color: Gray

Chevrolet Cobalt for Sale

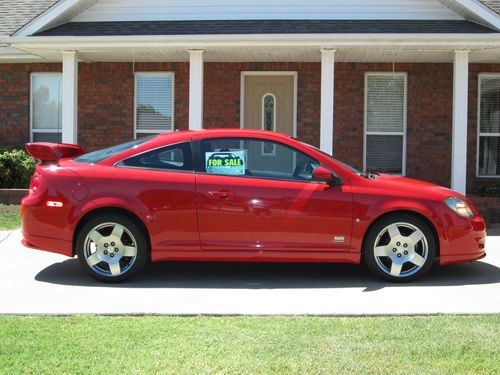

2007 chevrolet cobalt ss coupe 2-door 2.0l

2007 chevrolet cobalt ss coupe 2-door 2.0l 2009 cobalt ss turbo charged

2009 cobalt ss turbo charged 2009 chevrolet cobalt sedan 2lt lt *very good condition*

2009 chevrolet cobalt sedan 2lt lt *very good condition* 06 cobalt lt-86k-cd player-rear trunk spoiler-automatic-pwr windows-alloy wheels(US $5,995.00)

06 cobalt lt-86k-cd player-rear trunk spoiler-automatic-pwr windows-alloy wheels(US $5,995.00) Supercharged chevrolet cobalt ss coupe(US $10,700.00)

Supercharged chevrolet cobalt ss coupe(US $10,700.00) No reserve!!!!! 172,000 highway miles!!!!!!!!

No reserve!!!!! 172,000 highway miles!!!!!!!!

Auto Services in Indiana

Zamudio Auto Sales ★★★★★

Westgate Chrysler Jeep Dodge ★★★★★

Tom Roush Lincoln Mazda ★★★★★

Tim`s Wrecker Service & Garage ★★★★★

Superior Towing ★★★★★

Stan`s Auto Electric Inc ★★★★★

Auto blog

GM recalls 3.8 million vehicles in North America due to braking issue

Wed, Sep 11 2019WASHINGTON — General Motors Co said Wednesday it was recalling 3.46 million U.S. pickup trucks and SUVs to address a vacuum pump issue that could make braking more difficult and that has been linked to 113 accidents and 13 injuries. The recall covers 2014-2018 model year vehicles, including some Cadillac Escalade, Chevrolet Silverado, Chevrolet Tahoe, GMC Sierra, Chevrolet Suburban and GMC Yukon vehicles. In late June, GM recalled 310,000 vehicles in Canada for the same issue. GM did not immediately explain why the Canadian recall occurred more than two months before it called back the vehicles in the United States. The recall was triggered because the amount of vacuum created by the vacuum pump may decrease over time, GM told the National Highway Traffic Safety Administration (NHTSA) in documents posted on Wednesday. The NHTSA opened a preliminary investigation into the issue last November, and said it had reports of nine related crashes and two injuries. It provided GM in July with additional field reports that prompted the automaker to open an investigation. GM said it could affect braking in "rare circumstances." The NHTSA said in a statement the "vehicles may experience brake boost failure, which would require increased brake pedal effort, leading to a hard brake pedal feel, and potentially increased stopping distance." GM said dealers will reprogram the electronic brake control module to improve how the system utilizes the hydraulic brake boost assist function when vacuum assist is depleted. GM said the vacuum assist pump, which is lubricated with engine oil that flows into the pump through a filter screen, can in some cases lose effectiveness over time, as debris such as oil sludge can accumulate on the filter screen. GM told NHTSA that prior model years used a different brake assist system design, and vehicles manufactured after 2018 were not equipped with the affected pump design. Separately, GM said on Wednesday it is recalling 270,000 additional U.S. vehicles in three smaller recalls, including 177,000 2018 Chevrolet Malibu cars with 1.5L turbo engines because an error in the engine control module software may result in the fuel injectors being disabled.

Driving the C8 Corvette, and previewing GM's electric future | Autoblog Podcast #617

Fri, Mar 6 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by West Coast Editor James Riswick and Road Test Editor Zac Palmer. First they dive right in to the experience of driving the 2020 Chevrolet Corvette, followed by their review of the Mercedes-Benz GLE 350. Then they talk about the week's news, beginning with the whole slew of electric vehicles General Motors surprised us with at its EV Day. Next, they discuss the possibility of Porsche building a hybrid 911, as well as news about Ford's electric Transit van making its way to the U.S.. Last, but not least, they take to the mailbag to help a listener pick his next car in the "Spend My Money" segment. Autoblog Podcast #617 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Driving the 2020 Chevrolet Corvette Stingray Driving the 2020 Mercedes-Benz GLE 350 GM EV Day: Cadillac Celestiq and Lyriq, GMC Hummers and more A hybrid Porsche 911? Ford Transit electric commercial vans coming to U.S. Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

Should heavy-duty pickup trucks have window stickers with fuel mileage estimates?

Sat, Sep 23 2017If you were to stroll into your nearest Chevrolet, Ford, GMC, Nissan, or Ram dealership, you'd find a bunch of pickup trucks. Most of those would have proper window stickers labeled with things like base prices, options prices, location of manufacture, and, crucially, fuel economy estimates. But you'd also run across a number of heavy-duty trucks with no such fuel mileage data from the Environmental Protection Agency. The EPA doesn't require automakers to publish the valuable miles-per-gallon measurement for vehicles with gross weight ratings that exceed 8,500 pounds. That makes it difficult for consumers to compare behemoths powered by turbocharged diesel engines – between one another, and between smaller, gasoline-fueled trucks. Consumer Reports doesn't think it should be this way, and it's spearheading an effort (PDF link) to get the government to require manufacturers to publish fuel economy estimates. In its own testing, CR found that heavy-duty pickups powered by Ford's Power Stroke, GM's Duramax, and FCA's Cummins diesel engines (which doesn't include the Ram's EcoDiesel) get worse fuel mileage than their lighter-duty gas-powered siblings. We're not so sure HD-truck buyers are unaware of this fact – big diesels don't really come into their own until big loads are placed in their beds or attached to their trailer hitches. Under heavy workloads, the diesel trucks will almost certainly return greater efficiency than a similar gas-powered truck. What's more, HD trucks with lumbering diesels in general make the driver feel more confident while towing due to greater torque at low engine RPM than gas trucks. They also offer greater max-weight limits. Still, we agree EPA fuel mileage estimates should be offered for heavy-duty pickups. And we think the comparisons provided by Consumer Reports might be interesting to potential buyers. Click here to see the results of CR's tests, and let us know what you think using the poll below. Related Video: Featured Gallery 2017 Ford F-Series Super Duty: First Drive View 22 Photos News Source: Consumer Reports Government/Legal Green Read This Chevrolet Ford GMC Nissan RAM Fuel Efficiency Truck Commercial Vehicles Diesel Vehicles poll gmc sierra hd chevy silverado hd