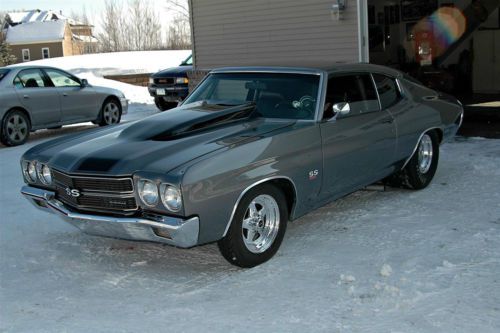

1970 Chevelle 454 Super Fast Ls6 Bored 496 on 2040-cars

Sayville, New York, United States

Chevrolet Chevelle for Sale

1967 chevelle station wagon all original paint & interior 63k miles blue/blue(US $6,350.00)

1967 chevelle station wagon all original paint & interior 63k miles blue/blue(US $6,350.00) Ls6 chevelle1970 4 speed project with buildsheet forrest green

Ls6 chevelle1970 4 speed project with buildsheet forrest green 1970 ls6 chevelle4 speed project with buildsheet

1970 ls6 chevelle4 speed project with buildsheet 1966 chevy chevelle bb automatic power steering power brakes ss clone

1966 chevy chevelle bb automatic power steering power brakes ss clone 1967 chevrolet chevelle big block 4spd manual transmission 12 bolt rear wheels(US $15,999.00)

1967 chevrolet chevelle big block 4spd manual transmission 12 bolt rear wheels(US $15,999.00) Chevrolet : chevelle coupe

Chevrolet : chevelle coupe

Auto Services in New York

Zona Automotive ★★★★★

Zima Tire Supply ★★★★★

Worlds Best Auto, Inc ★★★★★

Vip Honda ★★★★★

VIP Auto Group ★★★★★

Village Line Auto Body ★★★★★

Auto blog

Weekly Recap: Geneva's splendor reflects growing demand for ultra-luxury cars

Sat, Mar 7 2015Geneva is one of the most glittering auto shows in the world, but the list of high-powered and bespoke luxury cars was decadent this year even by the rich standards of the Swiss exhibition. It's great for enthusiasts to revel in the flame-throwing Aston Martin Vulcan, the racing-inspired elegance of the Bentley EXP 10 Speed 6 concept and the insane performance of the Lamborghini Aventador LP 750-4 Superveloce, but there's a reason for all of this opulence: the luxury market is big business. And it's growing. IHS Automotive forecasts that so-called ultra-premium sales will nearly triple this decade from 123,000 to 353,000 units around the world. The estimate includes brands like Aston Martin, Bentley, Ferrari and Rolls-Royce, but doesn't count BMW, Mercedes and Audi, which offer less expensive models in addition to their high-end flagships. Though IHS includes Porsche and its relatively large volume in the study, the ultra-premium segment is still set grow at about the same rate, even without the German automaker's figures. So what is propelling all of this growth in the most expensive segment of the auto industry? Put simply, there's more rich people. IHS Automotive principal analyst Tim Urquhart pointed to economic expansion in China, market recovery in the United States and a surge in the lucrative technology sector as contributing factors. This dovetails with a research report by UK-based Oxfam, an international relief organization, which found the world's richest one-percent owned 48 percent of global wealth in 2014, and it's expected to increase to more than 50 percent by 2016. View 17 Photos Carmakers are moving quickly to capitalize with new products, expanding their portfolios with low-volume speedsters like the 800-hp V12 Vulcan at Geneva, and plans to enter new segments, like Rolls-Royce's strategy to make an SUV. "Ultra-premium carmakers are looking to explore ways of growing their product offerings, and thus their bottom lines, in this most potentially profitable of segments," Urquhart wrote in a report on the Geneva show. In a nutshell, there are more choices for people with more money. It's a good time to have expensive taste. Other News & Notes 2016 Mazda MX-5 Miata production launches It won't be long now. The 2016 Mazda MX-5 Miata arrives later this year, and it's officially in production. Mazda announced this week that the roadster began rolling off the assembly line at its Ujina factory in Hiroshima, Japan.

MotorWeek turns back the clock with the 1994 Mustang and Camaro

Thu, Jan 14 2016The Ford Mustang and Chevrolet Camaro have battled it out for pony car supremacy for as long as most of us can remember, and the latest examples of both coupes continue to offer buyers impressive performance for their price. MotorWeek's Retro Review series remembers a classic battle in that fight in a video that pits the 1994 Mustang GT against the Camaro Z28 at Charlotte Motor Speedway. MotorWeek smokes the tires on both of these coupes at the speedway and shows off how they handle on track. Both vehicles come away with their own advantages in the challenge. The red Mustang packs Ford's 5.0-liter V8 with 215 horsepower and a five-speed manual gearbox. The MotorWeek crew praises the vehicle's stability at high speed and the ease of driving it around the track. The Camaro wins on power with a 275-hp 5.7-liter V8, and the show lauds the Chevy's six-speed manual. Check out the video to relive one entertaining skirmish in the ongoing pony car war. Related Video:

CNG Chevy Impala launch delay grows to a year

Fri, Jun 12 2015The 2015 Chevrolet Impala Bi-Fuel was announced in Washington D.C. in late 2013 by Dan Akerson and was supposed to be on sale by the summer of 2014. Capable of running on gasoline and compressed natural gas, the sedan was said to offer a novel solution at a time when gas prices were high. The vehicles still haven't arrived at dealers, though, and according to Automotive News, a quality issue has set back the launch even a few months more. Using a modified 3.6-liter V6 with hardened valves and valve seats, the Bi-Fuel Impala has separate tanks for gasoline and CNG that it can switch between on the fly. When running on the cheaper natural gas, the sedan was estimated to get 19 miles per gallon in the city and offer 150 miles of range, and the total driving distance was predicted at around 500 miles. The base price was set at $38,210, after the $825 destination charge. The only other major tradeoff was a smaller trunk to accommodate the extra fuel. However, the first shipments of the bi-fuel models now aren't expected until mid-July – about a year later than the scheduled launch. A memo to dealers obtained by Automotive News said the sedan "has been delayed by a second quality hold" to look at the CNG system. The exact details surrounding this problem haven't been released. "We have identified a solution to the delay and are working hard to implement it within the next few months," General Motors spokesperson Chad Lyons said to Automotive News. Around 200 Bi-Fuel Impalas have been made, but none are yet in the hands of customers. Dealers should be able to order 2016 model year examples starting in the third quarter of this year.