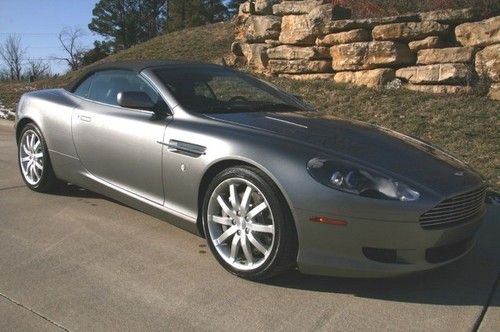

2007 Aston Martin Db9 Rare 6 Speed Manual Trans One Owner Very Clean Condition on 2040-cars

Ballwin, Missouri, United States

For Sale By:Dealer

Engine:6.0L 5935CC V12 GAS DOHC Naturally Aspirated

Body Type:Convertible

Transmission:Manual

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Aston Martin

Warranty: Vehicle does NOT have an existing warranty

Model: DB9

Trim: Volante Convertible 2-Door

Disability Equipped: No

Drive Type: RWD

Doors: 2

Mileage: 14,652

Drive Train: Rear Wheel Drive

Sub Model: 2DR VOLANTE

Number of Doors: 2

Exterior Color: Gray

Interior Color: Black

Number of Cylinders: 12

Aston Martin DB9 for Sale

2dr volante auto aston martin db9 volante low miles convertible gasoline 6.0l v1(US $73,000.00)

2dr volante auto aston martin db9 volante low miles convertible gasoline 6.0l v1(US $73,000.00) 2005 aston martin db9(US $64,888.00)

2005 aston martin db9(US $64,888.00) Almond green 20" gfg wheels tan leather stick shift gorgeous car!!(US $76,500.00)

Almond green 20" gfg wheels tan leather stick shift gorgeous car!!(US $76,500.00) 2006 aston martin db9. perfect condition. aston service history. $29,000 extras!(US $59,900.00)

2006 aston martin db9. perfect condition. aston service history. $29,000 extras!(US $59,900.00) 2005 aston martin db9. 9k miles. black leather interior. paddle shifters, clean(US $72,780.00)

2005 aston martin db9. 9k miles. black leather interior. paddle shifters, clean(US $72,780.00) Db9 convertible! asanti wheels! navigation! 6cd! v12! absolute stunner!(US $59,999.00)

Db9 convertible! asanti wheels! navigation! 6cd! v12! absolute stunner!(US $59,999.00)

Auto Services in Missouri

Western Tire & Auto ★★★★★

Valvoline Instant Oil Change ★★★★★

St Louis Car & Credit ★★★★★

St Louis Auto Parts Co ★★★★★

Specialty Automotive ★★★★★

SL Services Inc ★★★★★

Auto blog

How chasing Ferrari improved Aston Martin, with help from Mercedes-Benz

Tue, Apr 26 2022GAYDON, England — After decades of ups and downs, British carmaker Aston Martin Lagonda is charting a more efficient and profitable way forward, leaning on technology from shareholder Mercedes-Benz to make the costly leap to electric vehicles (EVs). Less than two years after billionaire Lawrence Stroll drove to the rescue of James Bond's car brand of choice, Aston Martin has undergone a manufacturing makeover to lift margins and help it become more like rival Ferrari. Stroll, Aston Martin's largest shareholder and executive chairman, who is also an avid fan of Ferrari, says after vehicle sales jumped 82% in 2021 the carmaker's transformation to long-term profitability is well under way, with new cars coming and funding secured through 2025. But analysts say Aston Martin, which has gone bust seven times since it was founded in 1913 and has flirted with death as often as Agent 007, is still burning through piles of cash. Some question its ability to generate Ferrari-like sales to fund the vast cost of electrification. "It's precarious and it is possible for this company to go bust," said Redburn equity research analyst Charles Coldicott. "I don't think it's a controversial thing to say even though Aston wouldn't like to hear it." Asked to comment on perceptions of a shaky future, an Aston Martin spokesman reiterated Stroll's view that the carmaker is well on the way to long-term profitability and that it has adequate access to cash. On a tour of the carmaker's Gaydon factory, Tobias Moers, formerly head of Mercedes' high-performance AMG brand and Aston Martin chief executive since August 2020, rattles off a list of moves including cutting one of two assembly lines and bringing more bespoke items like seats in-house. Perhaps the biggest shift has been to focus on higher-value customer-driven and customized orders — a big part of Ferrari's success — rather than over-producing and churning out sports cars wholesale, which then had to be discounted. "When I came in, the company was manufacturing-dominated instead of engineering-led, which for an auto luxury business is insane," Moers said. "In a company this size, you need maximum flexibility and agility." Moers has cut Aston Martin's inventory to 600 sports cars from 2,000 — its cars sell for an average of around 150,000 pounds ($195,750) — and customized orders now account for 50% of sales versus 6% when he joined the firm. At that point, the carmaker was in trouble after a disastrous 2018 public listing.

Aston Martin and Brough Superior go two-up on a range of motorcycles

Fri, Oct 25 2019With several auto and motorcycle shows yet to come before the end of the year, the back of the Tokyo Motor Show doesn't mean the end of teasers. Aston Martin has released the merest line drawing of its next collaboration, a project with the resurrected English bike maker Brough Superior Motorcycles (pronounced "bruff"). The tie-up will debut Nov. 5 at the EICMA motorcycle show in Milan, Italy, and Aston Martin says it "will showcase the integration of beautiful design and exquisite engineering in strictly limited-edition motorcycles." This will be the first time the carmaker's wings will appear on a motorbike. It'll be interesting to see how the partners merge what look like two divergent design philosophies. When Englishman Mark Upham brought Brough back to life in 2012, he asked Frenchman Thierry Henriette of Boxer Design to pen a new bike visually tied to the original Broughs from the 1920s. The SS100, re-creating Brough's most popular model, is compelling but not pretty nor sleek, hung throughout with weighty, overtly constructed metallic forms. The Anniversary and Pendine Sand Racer models are lighter, but just as art deco and cyberpunkish in ways that Aston Martin design is not. On the other hand, Brough was — and is — also known for using excellent materials, build quality and performance, and they aren't inexpensive. Plenty of overlap with the Gaydon car company there. Somehow out of all that will come, we are told, "the perfect balance between performance and design." Mercedes-AMG partnered with Ducati for a few years in the MotoGP racing series and on some AMG-themed bikes, then traded for a partnership with MV Agusta on the AMG-themed Solar Beam. However, those were basically paint jobs on bikes Ducati was already making. It sounds like Brough and Aston Martin intend a more involved venture — and "motorcycles," plural — between carmaker and bike builder than we've seen recently. We'll have more answers in two weeks.

Aston Martin brings ice driving program to America [w/video]

Wed, Mar 19 2014With between four and six hundred horsepower channeled to the rear wheels from a V8 or V12 engine mounted up front, an Aston Martin – any Aston Martin, really – might not seem like the smartest choice for driving on ice and snow. But that can also make it the most fun, and the most enlightening to experience. That's the point behind the Aston Martin On Ice program: allowing customers to drive the latest Gaydon has to offer on slippery, wintery surfaces. But whereas the On Ice program has been established for years in St. Moritz, Switzerland and in the Swedish Lapland, this year it arrived in America for the first time. A series of custom tracks – including a braking/cornering loop, slalom, skid pad and a full circuit – were carved into the snow in Crested Butte, CO, where expert driving instructors taught customers a thing or two about how to handle a powerful twelve-cylinder GT car like a DB9, Vanquish or V12 Vantage. The program has concluded for the season, returning next February, but in the meantime Aston will use the Colorado base camp as the center of its driving experience through the Rockies. Check out the video footage and the details in the press release below. ASTON MARTIN... ON ICE - New US ice driving program launches in Crested Butte, Colorado - Affords customers the opportunity to drive full Aston Martin range in extreme winter conditions - Utilises custom-built Aston Martin facility Irvine, CA, 17 March, 2014 – Aston Martin has launched the company's first ice driving program in North America, hosted at Crested Butte, Colorado providing customers with the ultimate driving experience against a stunning mountainous backdrop. Offering customers the opportunity to experience the full potential of the Aston Martin range and hone their driving skills, the new On Ice program took place in the heart of the Colorado Rocky Mountains in a unique setting, with an ice track custom built for the occasion as illustrated in a new film from the event, released today. Comprising a braking/cornering exercise loop, slalom, skid pad and full circuit, the bespoke Aston Martin track was especially constructed for the occasion over the last four months. Under expert tuition, participants were guided through the facility, embarking upon a series of braking, cornering and handling exercises before putting their skills to the test on a mile-long frozen road course.